CREDIT: MISSOURI LEGISLATIVE NETWORK

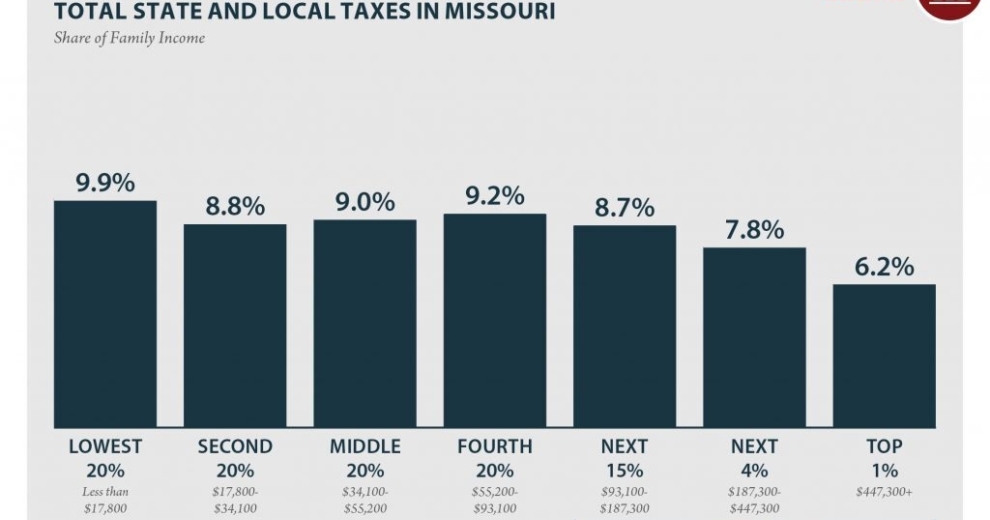

This is why your taxes continue to rise.

Corporations would pay no state income taxes under legislation the Missouri House of Representatives granted first-round approval on March 12th. The bill would cost the state an estimated $884.39 million a year in lost revenue once fully implemented in 2028.

The substantially reduced revenue collections that would result from eliminating the corporate income tax would be in addition to the billions the state has already forgone due to multiple large tax cuts the Republican-controlled General Assembly has enacted over the last decade, including a $2 billion income tax cut lawmakers approved just 18 months ago.

Although an influx of federal pandemic relief funds in recent years has so far masked the financial consequences of the tax cuts, that is ending with flat revenue collections expected for the upcoming 2025 fiscal year and revenue declines likely coming soon. Additional major tax cuts would greatly exacerbate the situation.

Down from a high of 6.5 percent, Missouri’s corporate income tax rate currently stands at 4 percent. Under House Bill 2274, the tax would be completely phased out over three years. Starting on Jan. 1st, 2025, the rate would drop by one percentage point per year until being zeroed out as of Jan. 1st, 2028. A second vote is required to advance the bill to the Senate.